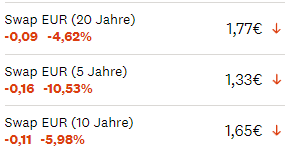

(Comparison to yesterday)

Holy moly, did I miss something? Compared to last week, the 10-year SWAP (which is often used here as an indicator for construction interest rates) is now almost 20%(!!) below the values from a week ago. Admittedly, last week it first went up slightly before going down, but these are basically May-level values now. Basically, after both the ECB rate hike and now the FED rate hike, it dropped significantly the following day. Whether it holds, no idea. Why it is like this? Also no idea (everything less high than worst feared?). Interest rate-wise, the KfW seems to adjust quite quickly (for the KFW-124 - already corrected down twice this week), so let’s see what happens in the next few days. We are actually considering sending our financing helper person, but somehow it's pretty wild right now o_O