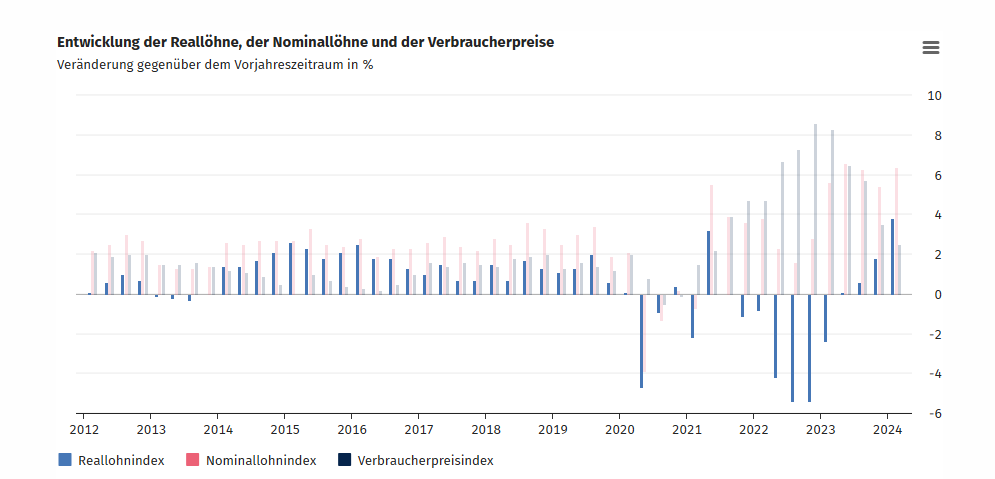

Despite massive inflation in recent years, which certainly affects not only construction and real estate prices but also all other areas, employees had to accept drastic real wage losses. Surely, there were also wage increases in some economic sectors.

Real wage increase: upward spike Real wage loss: downward spike

So much for your selective perception

The crisis in construction currently does not invite wage increases in the construction industry.

Collective agreement on 29.05. with strong wage increases. €230 base amount and additionally almost 10% (spread over the term), equalization of East wages to West level. Where do you actually get your information?

And despite millions of citizens receiving benefits and refugees, there is still a massive labor shortage. I do not mean the shortage of skilled, highly qualified international professionals. The labor shortage applies to all sectors and can be felt most especially in the low-wage sector. And I do wonder where this labor shortage comes from. Is it really due to demographics? Where have the workers gone? Why do only 80 percent of Ukrainian refugees work in other countries, but not in Germany?

Ah – immediately a change of topic again when you don't know what else to say.

You don’t need tables or statistics to know that,

No, we just have to ask you, because the tables and statistics are faked by those at the top anyway, right?

As of today, it is already the case that even well-off and well-paid employees find a house unaffordable. Even a doctor or engineer is having problems. For the middle class, it’s now almost excluded.

No. That is simply wrong. It is still quite possible. It is due to the expectations from the time when money cost nothing. Building big with a 60 sqm garage and every gadget in the house. Please back that up with numbers and facts. What kinds of households with which incomes and what equity? What kinds of properties can the groups mentioned not build or buy and for what reasons?

And no, it is not normal to finance with only 1 percent repayment over 30-40 years.

Not entirely correct. Not normal at zero interest rate levels. At 0.5% interest, 1% repayment results in a term of about 81 years. For 37 years, you need 2.5% repayment. At maybe 4% today and 1.5% repayment, you are at 33 years. At 6% interest and 1% repayment (at this interest level or higher, almost 100% of all mortgage financiers were set with this repayment), it is also only 33 years. So why should it be abnormal to repay low today? If you are not too old, the financing is done by retirement. And if not completely, so what?