Take a look at Wendlingen. Wendlingen wouldn’t normally be worth mentioning. It’s only so expensive because Stuttgart is within reach and Stuttgart is much, much more expensive. There is no other reason. If things go badly in Stuttgart, the price in Wendlingen will fall to a normal level. There are plenty of possibilities for that.

And yes, there are plenty of signs of a bubble. Apartments being sold for 50 annual cold rents and more. Extreme price increases in the last few years. If that doesn’t look like massive overvaluation, then it preempts a pretty severe inflation. This can’t be explained even remotely by low interest rates or demography alone.

Well, a curve where there are no price increases for a few years at first, and then it becomes double-digit annually, is normal.

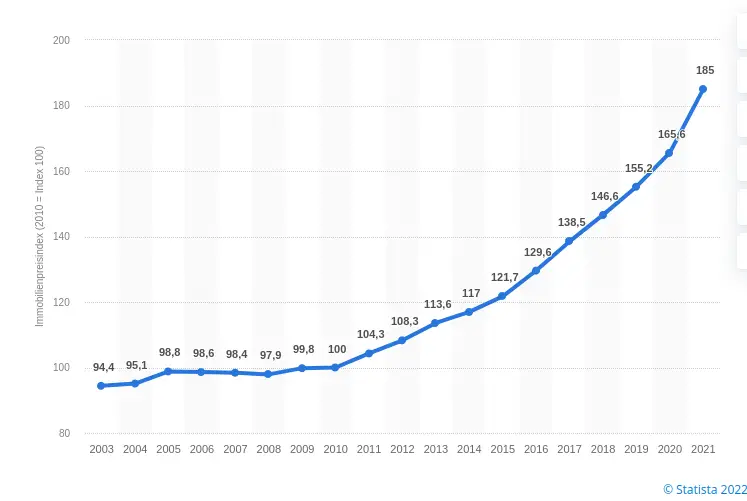

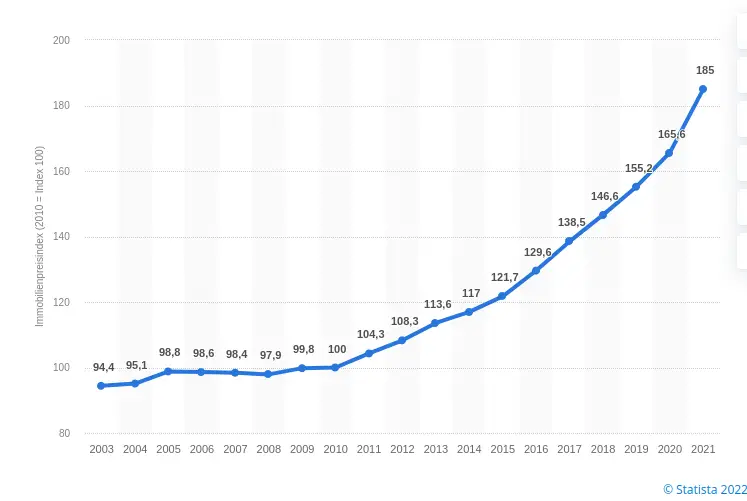

If you look at it from 2010 to today, there has been an 85% price increase in real estate prices.

BUT, if you look at it from 2000 to today, it was 82%! So in 20 years, less increase than in the last 11 years???

What is the reason?

You can look at the decades:

Inflation from 2000 to 2010 = index from 79.9 to 93.2 = 16.65% increase

Real estate prices from 2000 to 2010 = index from 84.4 to 83.9 = -0.60%, the prices fell in 10 years.

That means real estate lagged behind inflation here, i.e., you lost money with real estate...

How were the interest rates in that period from 2000 to 2010?

Because your argument is: rising interest rates = falling prices?

Interest rates fell from 2000 (about 7%) to 2005 (to about 4.5%),

then rose slightly from 2005 to 2008 (around 5%) and then fell again until 2010 below 4%.

So although the interest rate fell from 2000 (7%) to 2010 (to 4%), real estate prices in 2010 were lower than in 2000!

Despite falling prices, real estate prices remained stable, so interest rates had little impact on real estate prices!

Of course, with zero interest rate policy, where rates were below 1%, everyone also bought real estate because it was free money, and there were no interest payments on capital held at the bank.

Now in your example, I extend it to the full 21 years,

so from 2000 until today:

Real estate prices then increased by 82% (in more than 20 years! from 84.4 to 153.9)

Inflation: increased by 44% (from 79.9 to 114.8)

So still not as dramatic as it looks in the picture, real estate = 2x inflation, so in the last 10 years it was a good investment.

The important question is rather why it is like this? And upon closer inspection, I would say:

It is due to:

- low interest rates (but I would say only to a small extent)

- sharply rising construction costs (more so...) when construction costs rise, real estate prices also rise

If the new construction index in 2000 was at 100, now it is over 171 (November 2021), that is already a 71% increase!

(Close to the increased prices)

- legal requirements such as energy efficiency? We conveniently leave that out here completely.

How could houses be built in 2000? Low-energy house/passive house was probably the exception back then.

The Energy Saving Ordinance was introduced in 2000 and has been continuously adjusted. How much energy do houses built 20 years ago consume compared to today?

Because of the regulations, prices also rose automatically without market influence = also a reason for price increases.

And the regulations are getting stricter = price increase independent of interest rates!

(No oil heating, etc., i.e., so many requirements that make everything more expensive)

- Land, yes, there is plenty of it (NOT!) since it cannot be produced or multiplied here, prices for land in the near future will probably also rise disproportionately, independent of interest rates and construction costs

And yes, the companies' books are still full for 1-2 years, and then a correction could begin (could...)

Personally, I am of the opinion that we will see falling prices in the market if:

- craftsmen will have nothing more to do (so it won't happen completely, considering that currently you have to wait 6-9 months for craftsmen)

and small jobs do not come in at all (so the small jobs will also be worked off first)

> Here the question arises: if craftsmen then take 10-20% less wages but material becomes 10-20% more expensive due to increased energy costs, will it be cheaper overall?

- interest rates rise further, i.e., if they are over 3-4%

and people run out of EQUITY CAPITAL.

Consider that 20 years ago, financing was done with much less equity than today (equity capital today amounts to around 30% on average)

HERITAGE GENERATION, and if grandma/grandpa, parents get no interest for the money and it depreciates, the children/grandchildren get it for property!

And dear inflation, currently 7.3% in March

Interest rates would have to rise significantly so that people invest elsewhere than real estate (okay, there is the stock market... but for many it is bad, they don’t want to invest money there)

So no capital flight into real estate = that also drives the prices

And one could again add "politics":

What happens to detached single-family houses in regions where you no longer get building permits for detached single-family houses?

(In some regions already reality)

What happens to the prices there? Do they fall too? ;)

I think there is a lot to discuss about this, it may be that I am off with some points (I don’t have a crystal ball either...)

But if we want to continue having the EURO in the EU, interest rates must not rise too far, regardless of inflation.

Because otherwise there will be earthquakes in Italy, Spain, Portugal, etc., and that would probably be much worse than what happened with Greece back then...