Numborner

2020-07-27 22:02:36

- #1

Hello,

I came across your forum while searching online for answers to open questions.

I am from Saarland and my oldest son (I have 3 nice kids) would like to buy a used house in our local district. Yes, houses are currently outrageously expensive and I could probably sell our house for more than I built it for 25 years ago. Since then, a lot has changed regarding financing, etc., and we both have been to 2 banks for a house financing. We are unsure and therefore would rather ask competent forum members to at least get a trend or helpful suggestions for the further process.

Key data:

My son is 23 years old, his partner is also 23 and they have a 2-year-old sweet son, my first grandchild )

My son is trained and earns about 2400 net and the boss is currently taking her exam and will earn about 1900€.

They have been living in an apartment nearby for 2.5 years and pay 520€ rent there.

Of course, they would prefer to acquire something of their own rather than paying rent.

The house was built in 1966, beautiful plot and unfortunately in need of renovation, but the basic structure is okay, has already been checked.

Purchase price 185,000€ and estimated 100,000€ renovation costs (windows, front door, ceilings, floors, walls, radiator replacement, etc.), so including property transfer tax, etc., 300,000€.

The roof is made of Eternit and according to the roofer will last another 7-8 years, then a new one might be necessary. (Costs about 20,000)

We actually have no green thumbs but can help him renovate, people and motivation are not lacking (Saarlanders after all), but certain trades have to be done by professionals (e.g. windows).

Now to the actual financing:

Both have not really saved much so far, rather small amounts, and ultimately it can be regarded as full financing.

There are 2 offers (both actually reputable banks):

Bank1 = 1 x interest-only loan + building savings contract with Riester

Bank2 = 1 x interest-only loan + building savings contract (so far) without Riester

=> Advisor said you can make something good with Riester but it is somewhat uncertain because of subsequent taxation, etc. and you would have to want it. But of course he would also calculate and offer such a variant.

This bank, for example, does not finance the property transfer tax, so that would have to be declared differently in the costs.

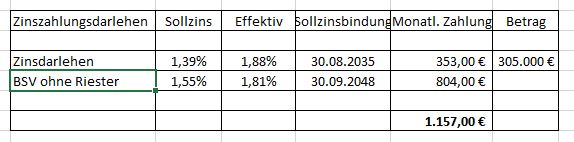

Starting with the one without Riester,

Bank2:

Interest-only loan with 15 years fixed rate and then the building savings contract applies.

He can make special repayments up to 5%.

Deduction would be €1157 for 15 years and then €1159, thus almost identical deduction.

End of all payments would be 2048 and in total they would pay €390,701.

I cannot assess tax advantages.

We asked how it would look if you only financed, for example, 90% and for example made 10% as a land charge on our paid-off house or if equity was available (grandma, grandpa, etc.), then the interest rate for the interest-only loan would fall by another 1.3%, so 1.23%.

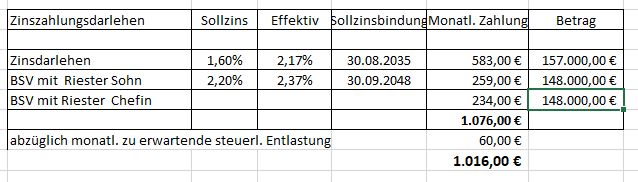

Bank1:

Interest-only loan with 15 years fixed rate and then the building savings contract and Riester apply.

So

14 years 1080€,

1 year 1148€

12 years 1220€

1 year 991€

1 year 657€

Total sum 392,000€

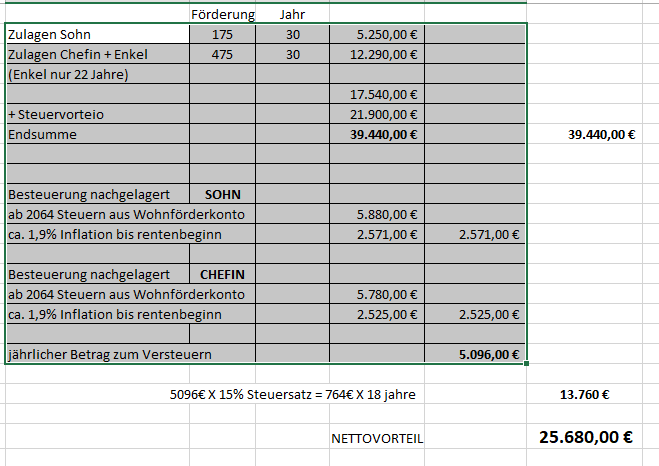

Then comes Riester

My understanding would now be that these €25,680 should be deducted from the €392,000 and the ultimately payable amount would thus be "only" €366,320.

But does this Riester calculation also add up?

15% taxes in the retirement phase?

1.9% inflation until then?

What do you think

- about the key data,

- income to deduction ratio (tight financing?)

- with or without Riester?

- what should be considered

I still have a lot of data sheets from the individual offers here, if something important is missing, please ask.

We would be happy if you could give us decision-making aids, tips, and suggestions. We have no one in our close circle who really knows about this.

PS: My son went to Bank1 today and is having the whole thing calculated analogously to Bank2 without Riester:

Greetings from warm Saarland

I came across your forum while searching online for answers to open questions.

I am from Saarland and my oldest son (I have 3 nice kids) would like to buy a used house in our local district. Yes, houses are currently outrageously expensive and I could probably sell our house for more than I built it for 25 years ago. Since then, a lot has changed regarding financing, etc., and we both have been to 2 banks for a house financing. We are unsure and therefore would rather ask competent forum members to at least get a trend or helpful suggestions for the further process.

Key data:

My son is 23 years old, his partner is also 23 and they have a 2-year-old sweet son, my first grandchild )

My son is trained and earns about 2400 net and the boss is currently taking her exam and will earn about 1900€.

They have been living in an apartment nearby for 2.5 years and pay 520€ rent there.

Of course, they would prefer to acquire something of their own rather than paying rent.

The house was built in 1966, beautiful plot and unfortunately in need of renovation, but the basic structure is okay, has already been checked.

Purchase price 185,000€ and estimated 100,000€ renovation costs (windows, front door, ceilings, floors, walls, radiator replacement, etc.), so including property transfer tax, etc., 300,000€.

The roof is made of Eternit and according to the roofer will last another 7-8 years, then a new one might be necessary. (Costs about 20,000)

We actually have no green thumbs but can help him renovate, people and motivation are not lacking (Saarlanders after all), but certain trades have to be done by professionals (e.g. windows).

Now to the actual financing:

Both have not really saved much so far, rather small amounts, and ultimately it can be regarded as full financing.

There are 2 offers (both actually reputable banks):

Bank1 = 1 x interest-only loan + building savings contract with Riester

Bank2 = 1 x interest-only loan + building savings contract (so far) without Riester

=> Advisor said you can make something good with Riester but it is somewhat uncertain because of subsequent taxation, etc. and you would have to want it. But of course he would also calculate and offer such a variant.

This bank, for example, does not finance the property transfer tax, so that would have to be declared differently in the costs.

Starting with the one without Riester,

Bank2:

Interest-only loan with 15 years fixed rate and then the building savings contract applies.

He can make special repayments up to 5%.

Deduction would be €1157 for 15 years and then €1159, thus almost identical deduction.

End of all payments would be 2048 and in total they would pay €390,701.

I cannot assess tax advantages.

We asked how it would look if you only financed, for example, 90% and for example made 10% as a land charge on our paid-off house or if equity was available (grandma, grandpa, etc.), then the interest rate for the interest-only loan would fall by another 1.3%, so 1.23%.

Bank1:

Interest-only loan with 15 years fixed rate and then the building savings contract and Riester apply.

So

14 years 1080€,

1 year 1148€

12 years 1220€

1 year 991€

1 year 657€

Total sum 392,000€

Then comes Riester

My understanding would now be that these €25,680 should be deducted from the €392,000 and the ultimately payable amount would thus be "only" €366,320.

But does this Riester calculation also add up?

15% taxes in the retirement phase?

1.9% inflation until then?

What do you think

- about the key data,

- income to deduction ratio (tight financing?)

- with or without Riester?

- what should be considered

I still have a lot of data sheets from the individual offers here, if something important is missing, please ask.

We would be happy if you could give us decision-making aids, tips, and suggestions. We have no one in our close circle who really knows about this.

PS: My son went to Bank1 today and is having the whole thing calculated analogously to Bank2 without Riester:

Greetings from warm Saarland