SaniererNRW123

2022-10-09 22:23:33

- #1

Once again summarized:

You take out two loans (regardless of which banks). Both loan agreements are signed by you. The parents only sign the mortgage registration on their house as well as the purpose declaration (that the mortgage is for your loan).

You only get a KFW loan as a simple component (regardless of what you use it for):

You do not get a subsidized loan for renovation/refurbishment measures. For that, you would have to invest a few more € and renovate to the corresponding efficiency house.

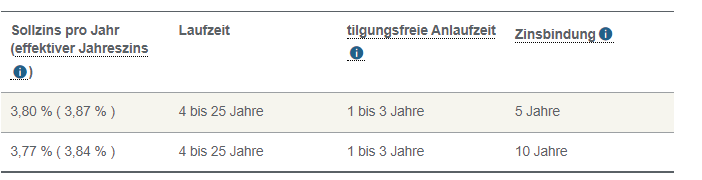

In terms of conditions, the KfW loan is crappy and only has an interest rate fixation of up to 10 years.

You take out two loans (regardless of which banks). Both loan agreements are signed by you. The parents only sign the mortgage registration on their house as well as the purpose declaration (that the mortgage is for your loan).

You only get a KFW loan as a simple component (regardless of what you use it for):

You do not get a subsidized loan for renovation/refurbishment measures. For that, you would have to invest a few more € and renovate to the corresponding efficiency house.

In terms of conditions, the KfW loan is crappy and only has an interest rate fixation of up to 10 years.