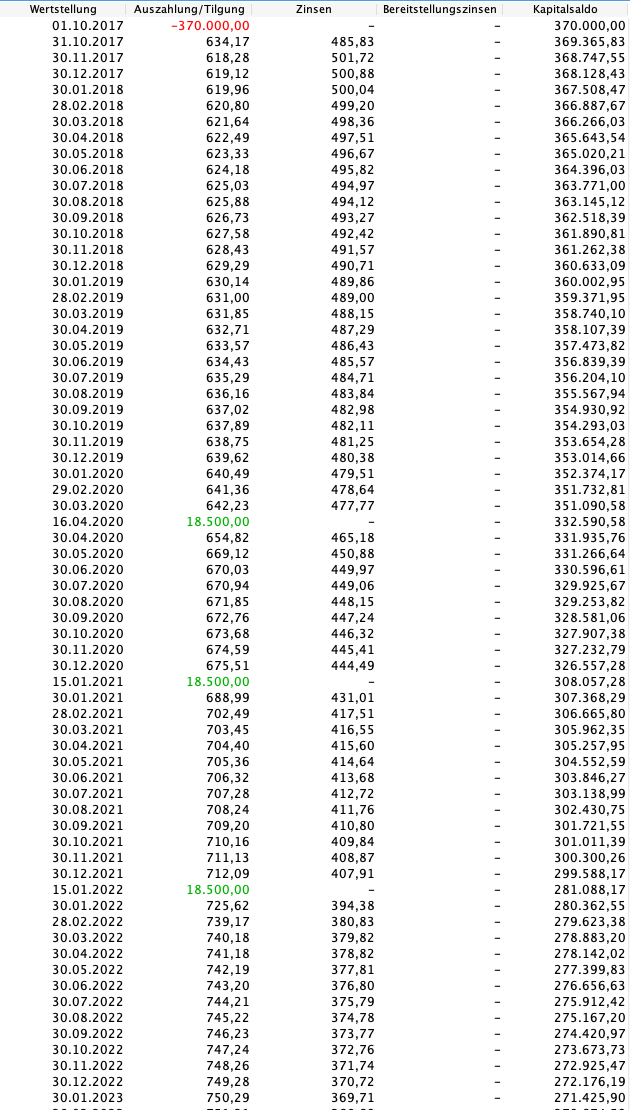

Hi, I quickly calculated this. Assuming that 100% was paid out on 1.10.2017 and with a

Nominalzins of 1.63%, you would have an outstanding debt of: 350,447 as of 30.04.2020. The

Gesamtzinsen - if nothing ever changes (rate, interest rate) - would be 121,349€, with the last payment on 30.04.2054. If you make a special repayment of 18,500€ today, the total interest burden is reduced by more than 13,000€ to 108,245€, with the last payment on 30.12.2051. Since 5% special repayment per calendar year is common, this could be done entirely without VfE. I think this is so favorable that it’s worth it.

If you make further repayments of 18,500€ each on 15.10.2021 and 15.01.2022, the interest savings would already be around 35,000€. The last payment would then be on 30.80.2047.

(All calculations assume that the interest rate remains unchanged until the end of the term. If you want me to calculate with different interest rates: gladly.)