I'm going to leave out the whole apocalypse theory with "currency system collapse" for now; you probably can't plan sensibly for that case anyway. For that, I tied a Nokia 3310 with duct tape to a stick.

For the more realistic scenarios, I initially also considered a longer fixed interest period. I then calculated the total costs in an Excel spreadsheet. If you choose the longer fixed period, you already pay higher costs in the first 10 years. With the lower interest rate, you can repay significantly more with the same installment – so I calculated in Excel what each of the two loans would cost me overall. Once with the full fixed interest period (I think we were offered 30 years), and once the short one.

I then continued calculating with hypothetical follow-up interest rates after 15 years (various scenarios). And came to the conclusion that only from a follow-up interest rate of about 3.8% onwards would the 30-year offer be cheaper in total costs.

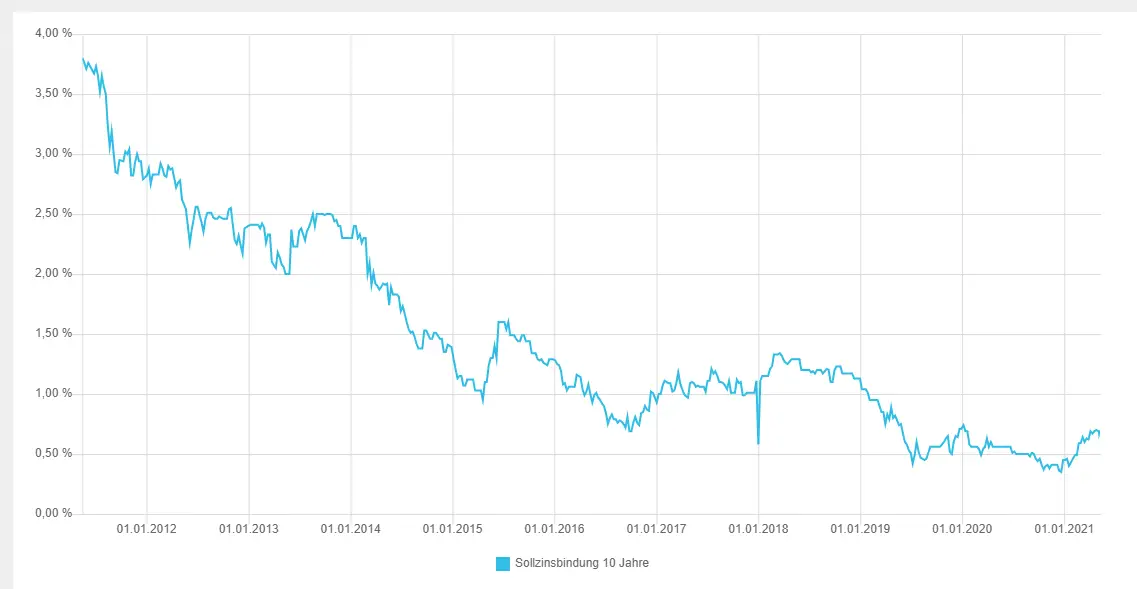

That would have looked something like this in the graphic, and personally, I considered the interest rate development unlikely. Not impossible, of course, but unlikely.