Bauexperte

2012-02-29 11:48:12

- #1

Solar and photovoltaic systems are being operated on the roofs of more and more homeowners. This applies not only to owner-occupied homes but also to entrepreneurs who install panels on factory halls or factory roofs. Besides environmental aspects, it is also essential that the prices for new systems have dropped significantly. The reason for this is the massively increased demand as well as technical progress. At the same time, the systems are becoming more efficient and can generate more energy than ever before.

Thanks to the support provided by the Renewable Energy Sources Act (EEG), this environmentally friendly way of generating energy is worthwhile. The Renewable Energy Sources Act obliges energy supply companies to purchase the electricity for 20 years with fixed feed-in tariffs (§ 21 Abs. 2 Renewable Energy Sources Act). This also applies after the recent reduction of support rates, which took place in several steps on 1.7.2010, 1.10.2010, and 1.1.2011 and again from New Year's Day 2012 by 15%. Operators now receive between 17.94 and 24.43 cents per kilowatt hour (kWh) of electricity, depending on the location and size of their solar power system, which they feed into the public electricity grid. In addition, they benefit from favorable tax conditions.

The amount of remuneration for electricity from solar radiation energy depends mainly on the performance of the system and the solar irradiation. This results in the amount of surplus electricity that is not needed for private use, which a property owner can sell to the grid operator at a fixed price.

Practical tip:

The neutral Renewable Energy Sources Act Clearing Office of the Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety offers the possibility to resolve or avoid disputes quickly, efficiently, and cost-effectively. It acts as a neutral mediator and offers methods of out-of-court dispute resolution to make court proceedings unnecessary. Upon request, the Clearing Office assesses the specific case as an expert panel; the opinions are not legally binding. The parties can then achieve binding effect through a settlement.

The increased environmental awareness and trend toward solar systems can also be seen in the fact that electricity became significantly more expensive for customers on New Year's Day 2012. They now pay not 2 but a whopping 3.5 cents levy per kWh for renewable energies because energy suppliers have to purchase more and more power from solar electricity. While it was around 6,000 megawatts (MW) in 2008, it is expected to be 20,000 MW this year.

Expansion of solar energy has costly consequences for consumers: In 2012 alone, electricity customers will pay a total of 14 billion EUR for the promotion of renewable energies. Photovoltaics generate only 3% of German electricity but cause 50% of the funding costs.

The rapid development has resulted in around 7.5 gigawatts (GW) of new capacity being installed in Germany each of the last two years. However, this has the negative consequence that other subsidies have been cut. There is now no subsidy at all for electricity from systems on former arable land.

On 1.1.2011, the support for solar electricity was cut again by 13%, and from 2012 the remuneration was planned to decrease by a further 15%. Thus, the remuneration for solar electricity has almost halved from the end of 2008 until today, and from 2017 the first system types will no longer require support under the Renewable Energy Sources Act.

Since the increased willingness to install causes high costs through the Renewable Energy Sources Act levy and burdens the electricity consumer, costs and the expansion amount are to be limited. For this purpose, the Federal Ministry for the Environment and the Federal Ministry for Economic Affairs agreed on new regulations for solar electricity support on 23.2.2012:

On the one hand, a significant one-time reduction in remuneration is to be used to adjust to the decreased market prices and to limit the additional capacity, and on the other hand, only a certain percentage of the generated electricity should be remunerated in the future, with the non-remunerated electricity either consumed itself or sold on the market. A fixed monthly reduction is also intended to prevent advance effects.

The following specific measures are planned for this purpose:

• Additional one-time reduction for all system types on 9.3.2012: the remuneration rates will then be for systems up to 10 kW: 19.5 cents/kWh, up to 1,000 kW: 16.5 cents, and up to 10 MW: 13.5 cents.

• From 1.5.2012 onward, increased degression by a reduction of remuneration rates: the remuneration degression occurs monthly and amounts to 0.15 cents/kWh per month.

• Introduction of a limited eligible electricity quantity for all new systems at 85% (small rooftop systems up to 10 kW generated annual electricity) and 90% (all other systems). This is to apply from 1.1.2013 for all systems commissioned from 9.3.2012.

• Short-term adjustment of remuneration in case of exceeding or undershooting the corridor for additional capacity and continuous reduction from 2014 onwards by ordinance of the Federal Ministry for the Environment in agreement with the Federal Ministry for Economic Affairs.

• There will only be 3 categories in the future (rooftop systems up to 10 kW, rooftop systems up to 1,000 kW, large systems from 1,000 kW to 10 MW (rooftop and free-field)) and no remuneration for larger systems.

• Elimination of the self-consumption bonus according to the Renewable Energy Sources Act.

• Rooftop systems on newly constructed non-residential buildings in rural areas will in future receive remuneration according to the tariff for free-field systems.

• Older photovoltaic systems will in the future have to contribute to grid stability. The costs for conversion will be financed half each by grid charges and the Renewable Energy Sources Act levy and will be borne by the grid operators. System operators are obliged to tolerate and cooperate with the conversion. In case of lack of cooperation, they permanently lose the entitlement to remuneration.

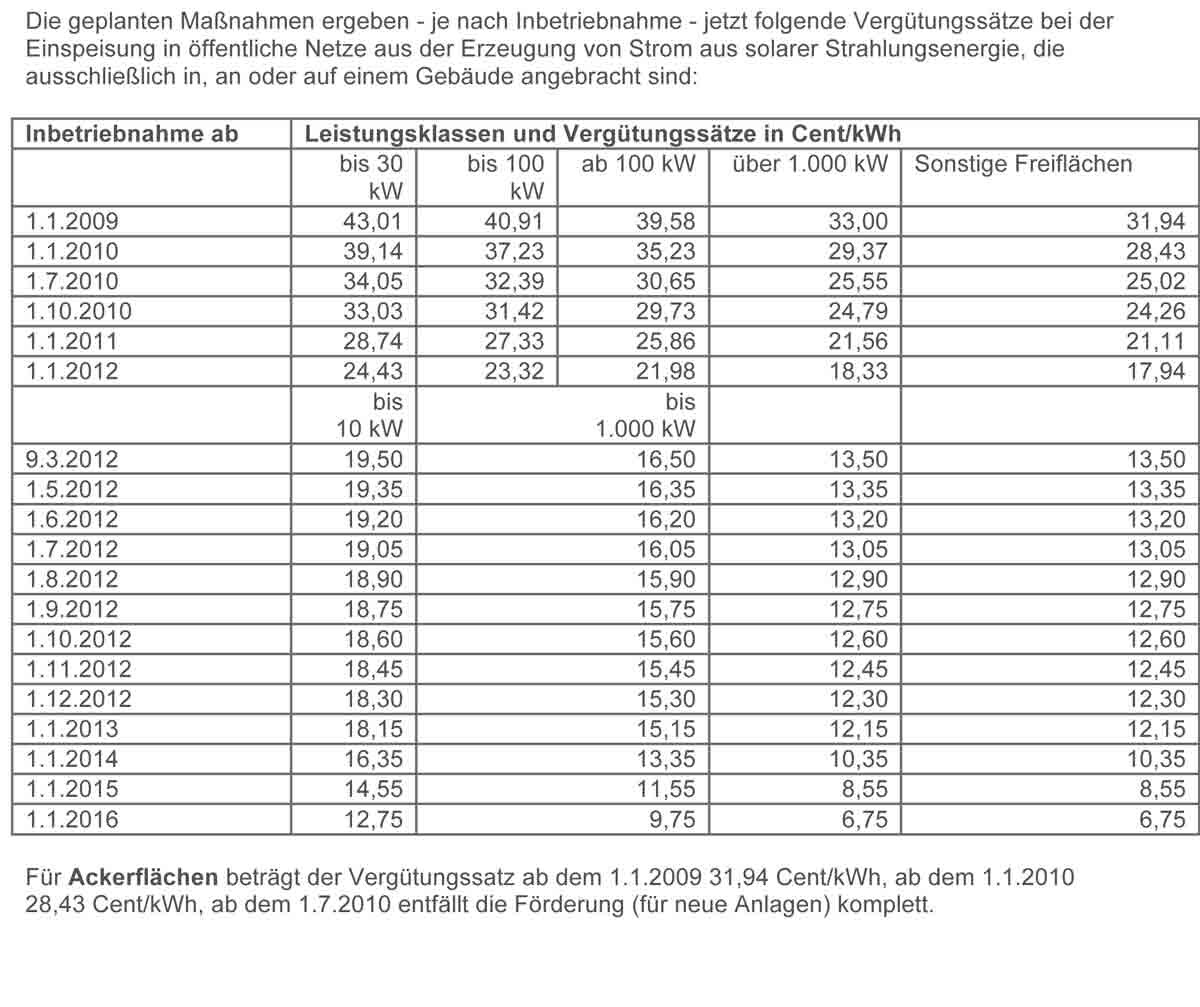

The planned measures now result – depending on commissioning – in the following remuneration rates for feed-in to public grids from the generation of electricity from solar radiation energy, which is exclusively installed in, on, or on a building:

=> System 1

Note:

The statutory reduction of remuneration rates on the respective dates does not apply to systems that were already commissioned before. For all systems commissioned before the law came into force, the previous (higher) remuneration rates continue to apply. The aforementioned remuneration rates are net prices, so VAT is added on top (§ 18 Abs. 3 Renewable Energy Sources Act). Private homeowners also become entrepreneurs by feeding solar electricity into public grids.

Currently, there are differing remuneration rates for annual self-consumption. According to the federal government's plans, the self-consumption bonus is now to be eliminated. This is to apply from 1.1.2013 for all systems commissioned from 9.3.2012. The elimination of the self-consumption bonus according to the Renewable Energy Sources Act 2012 is thus intended to relieve the Renewable Energy Sources Act levy.

For systems already installed, there is an entitlement up to a quota of 30%, which is 16.38 cents below the corresponding feed-in tariff (§ 33 Abs. 2 Sentence 2 No. 2 Renewable Energy Sources Act). If the share of self-generated electricity exceeds the 30% mark annually, the kilowatt-hour is supported at a feed-in tariff reduced by 12 cents. Since the remuneration claim depends overall on the system size as well as the self-consumption share, a high self-consumption share thus has a positive economic and financial effect for the system operator.

Commissioning from Performance classes and remuneration rates in cents/kWh ...

=> System 2

Source: 29.02.2012 Haufe.Taxes

Kind regards

Thanks to the support provided by the Renewable Energy Sources Act (EEG), this environmentally friendly way of generating energy is worthwhile. The Renewable Energy Sources Act obliges energy supply companies to purchase the electricity for 20 years with fixed feed-in tariffs (§ 21 Abs. 2 Renewable Energy Sources Act). This also applies after the recent reduction of support rates, which took place in several steps on 1.7.2010, 1.10.2010, and 1.1.2011 and again from New Year's Day 2012 by 15%. Operators now receive between 17.94 and 24.43 cents per kilowatt hour (kWh) of electricity, depending on the location and size of their solar power system, which they feed into the public electricity grid. In addition, they benefit from favorable tax conditions.

The amount of remuneration for electricity from solar radiation energy depends mainly on the performance of the system and the solar irradiation. This results in the amount of surplus electricity that is not needed for private use, which a property owner can sell to the grid operator at a fixed price.

Practical tip:

The neutral Renewable Energy Sources Act Clearing Office of the Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety offers the possibility to resolve or avoid disputes quickly, efficiently, and cost-effectively. It acts as a neutral mediator and offers methods of out-of-court dispute resolution to make court proceedings unnecessary. Upon request, the Clearing Office assesses the specific case as an expert panel; the opinions are not legally binding. The parties can then achieve binding effect through a settlement.

The increased environmental awareness and trend toward solar systems can also be seen in the fact that electricity became significantly more expensive for customers on New Year's Day 2012. They now pay not 2 but a whopping 3.5 cents levy per kWh for renewable energies because energy suppliers have to purchase more and more power from solar electricity. While it was around 6,000 megawatts (MW) in 2008, it is expected to be 20,000 MW this year.

Expansion of solar energy has costly consequences for consumers: In 2012 alone, electricity customers will pay a total of 14 billion EUR for the promotion of renewable energies. Photovoltaics generate only 3% of German electricity but cause 50% of the funding costs.

The rapid development has resulted in around 7.5 gigawatts (GW) of new capacity being installed in Germany each of the last two years. However, this has the negative consequence that other subsidies have been cut. There is now no subsidy at all for electricity from systems on former arable land.

On 1.1.2011, the support for solar electricity was cut again by 13%, and from 2012 the remuneration was planned to decrease by a further 15%. Thus, the remuneration for solar electricity has almost halved from the end of 2008 until today, and from 2017 the first system types will no longer require support under the Renewable Energy Sources Act.

Since the increased willingness to install causes high costs through the Renewable Energy Sources Act levy and burdens the electricity consumer, costs and the expansion amount are to be limited. For this purpose, the Federal Ministry for the Environment and the Federal Ministry for Economic Affairs agreed on new regulations for solar electricity support on 23.2.2012:

On the one hand, a significant one-time reduction in remuneration is to be used to adjust to the decreased market prices and to limit the additional capacity, and on the other hand, only a certain percentage of the generated electricity should be remunerated in the future, with the non-remunerated electricity either consumed itself or sold on the market. A fixed monthly reduction is also intended to prevent advance effects.

The following specific measures are planned for this purpose:

• Additional one-time reduction for all system types on 9.3.2012: the remuneration rates will then be for systems up to 10 kW: 19.5 cents/kWh, up to 1,000 kW: 16.5 cents, and up to 10 MW: 13.5 cents.

• From 1.5.2012 onward, increased degression by a reduction of remuneration rates: the remuneration degression occurs monthly and amounts to 0.15 cents/kWh per month.

• Introduction of a limited eligible electricity quantity for all new systems at 85% (small rooftop systems up to 10 kW generated annual electricity) and 90% (all other systems). This is to apply from 1.1.2013 for all systems commissioned from 9.3.2012.

• Short-term adjustment of remuneration in case of exceeding or undershooting the corridor for additional capacity and continuous reduction from 2014 onwards by ordinance of the Federal Ministry for the Environment in agreement with the Federal Ministry for Economic Affairs.

• There will only be 3 categories in the future (rooftop systems up to 10 kW, rooftop systems up to 1,000 kW, large systems from 1,000 kW to 10 MW (rooftop and free-field)) and no remuneration for larger systems.

• Elimination of the self-consumption bonus according to the Renewable Energy Sources Act.

• Rooftop systems on newly constructed non-residential buildings in rural areas will in future receive remuneration according to the tariff for free-field systems.

• Older photovoltaic systems will in the future have to contribute to grid stability. The costs for conversion will be financed half each by grid charges and the Renewable Energy Sources Act levy and will be borne by the grid operators. System operators are obliged to tolerate and cooperate with the conversion. In case of lack of cooperation, they permanently lose the entitlement to remuneration.

The planned measures now result – depending on commissioning – in the following remuneration rates for feed-in to public grids from the generation of electricity from solar radiation energy, which is exclusively installed in, on, or on a building:

=> System 1

Note:

The statutory reduction of remuneration rates on the respective dates does not apply to systems that were already commissioned before. For all systems commissioned before the law came into force, the previous (higher) remuneration rates continue to apply. The aforementioned remuneration rates are net prices, so VAT is added on top (§ 18 Abs. 3 Renewable Energy Sources Act). Private homeowners also become entrepreneurs by feeding solar electricity into public grids.

Currently, there are differing remuneration rates for annual self-consumption. According to the federal government's plans, the self-consumption bonus is now to be eliminated. This is to apply from 1.1.2013 for all systems commissioned from 9.3.2012. The elimination of the self-consumption bonus according to the Renewable Energy Sources Act 2012 is thus intended to relieve the Renewable Energy Sources Act levy.

For systems already installed, there is an entitlement up to a quota of 30%, which is 16.38 cents below the corresponding feed-in tariff (§ 33 Abs. 2 Sentence 2 No. 2 Renewable Energy Sources Act). If the share of self-generated electricity exceeds the 30% mark annually, the kilowatt-hour is supported at a feed-in tariff reduced by 12 cents. Since the remuneration claim depends overall on the system size as well as the self-consumption share, a high self-consumption share thus has a positive economic and financial effect for the system operator.

Commissioning from Performance classes and remuneration rates in cents/kWh ...

=> System 2

Source: 29.02.2012 Haufe.Taxes

Kind regards