Chris2806

2018-06-27 19:34:10

- #1

Ok, that actually sounds confusing :) I made a typo with ERGO. It was also about €350,000.

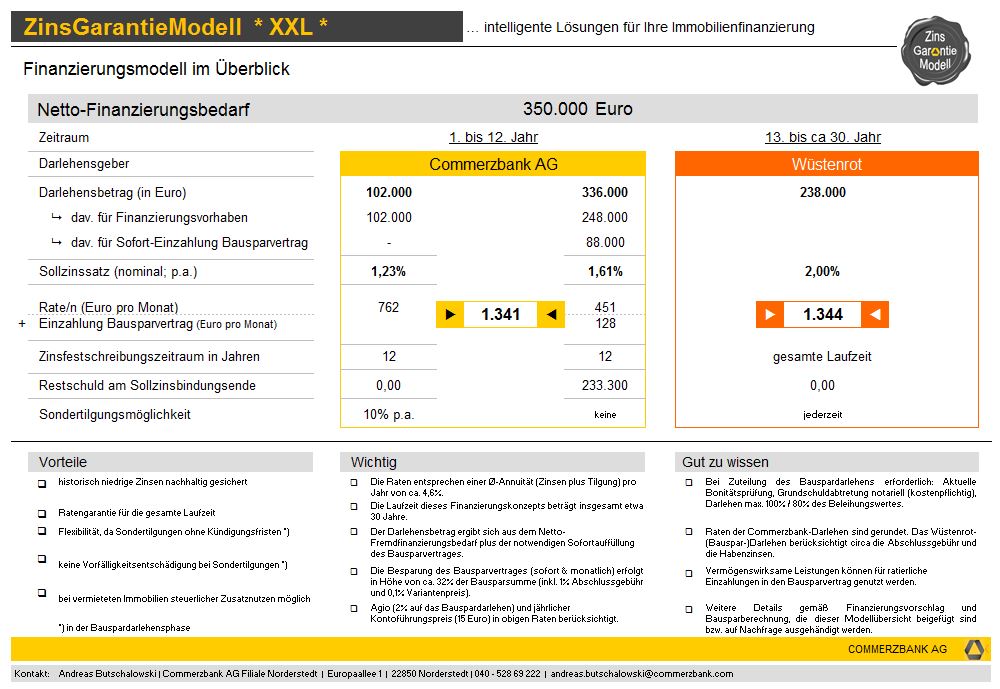

For better understanding, I have attached the overview as a graphic.

Since our official and personal appointment at the Commerzbank is only next Monday, we already had a preliminary phone conference today in which the data was roughly explained to me in advance. The detailed explanation will follow next week. As I said, I just want to prepare well in advance :(

P.S.: The plot is located in the district of Lüneburg and officially belongs to the "Hamburg metropolitan area" :)

For better understanding, I have attached the overview as a graphic.

Since our official and personal appointment at the Commerzbank is only next Monday, we already had a preliminary phone conference today in which the data was roughly explained to me in advance. The detailed explanation will follow next week. As I said, I just want to prepare well in advance :(

P.S.: The plot is located in the district of Lüneburg and officially belongs to the "Hamburg metropolitan area" :)