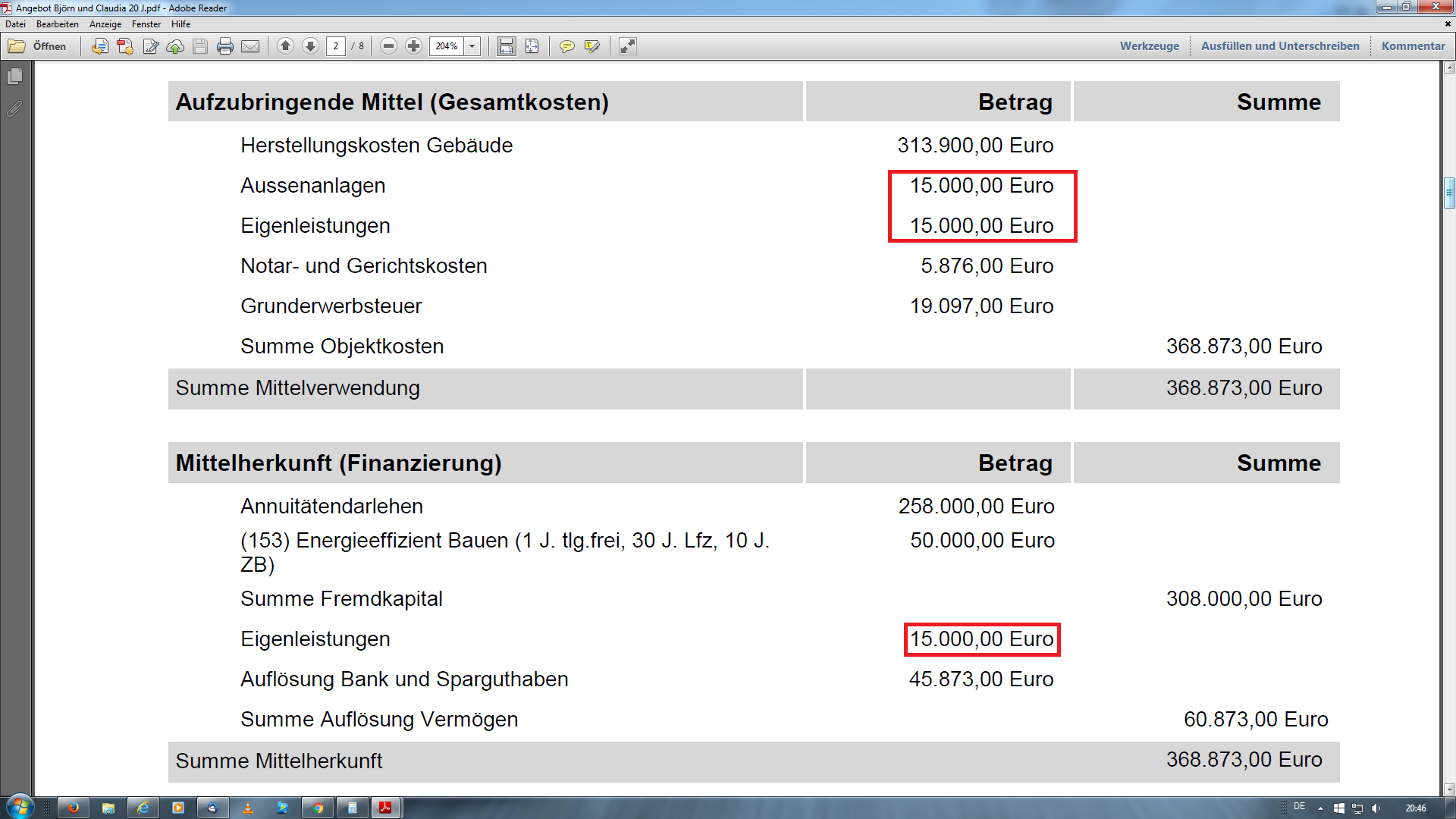

Maybe a finance expert here in the forum can help me. I spoke for over 30 minutes with a good acquaintance who is a mortgage financer and I still don't understand it. What exactly is "Muskelhypothek Eigenleistung"? I thought it increases the equity. So why does this item also appear under expenses? Why are the exterior facilities listed again?

The house costs €293,800, my acquaintance had already included the special requests of €20,100. You only pay purchase incidental costs on the value of the house, so don’t be surprised by the total incidental purchase costs.

We have €55,000 equity. I told him we want to use €35,000 for financing and €20,000 for the kitchen, flooring, walls/ceiling, and the garden.

He then said that is not a good idea. He allows €10,000 for the kitchen and adds €45,000. I then said "wait," then we don’t have any money left for the flooring, walls/ceiling, and the garden. Then he said we can declare €15,000 as Eigenleistung (I have no idea why these appear as expenses [he said it increases the value of the property]). I understood him as saying we can pay ourselves the €15,000 if we provide invoices. I agreed to that.

Now he told me, no, regarding the €15,000 Eigenleistung under expenses, I don’t have access to that at all; that €15,000 is for the exterior facilities.

I just don’t get it anymore. Maybe someone can explain the point of "Muskelhypothek" to me more precisely.

I tell the bank I do the work and not the craftsmen. The trades cost €15,000, that’s why they are probably listed under expenses. Since I do them, they are also listed under equity. Why can I not access these €15,000 that the bank co-finances to buy materials or pay craftsmen?