Holzhaus_TÜ

2015-04-14 23:19:25

- #1

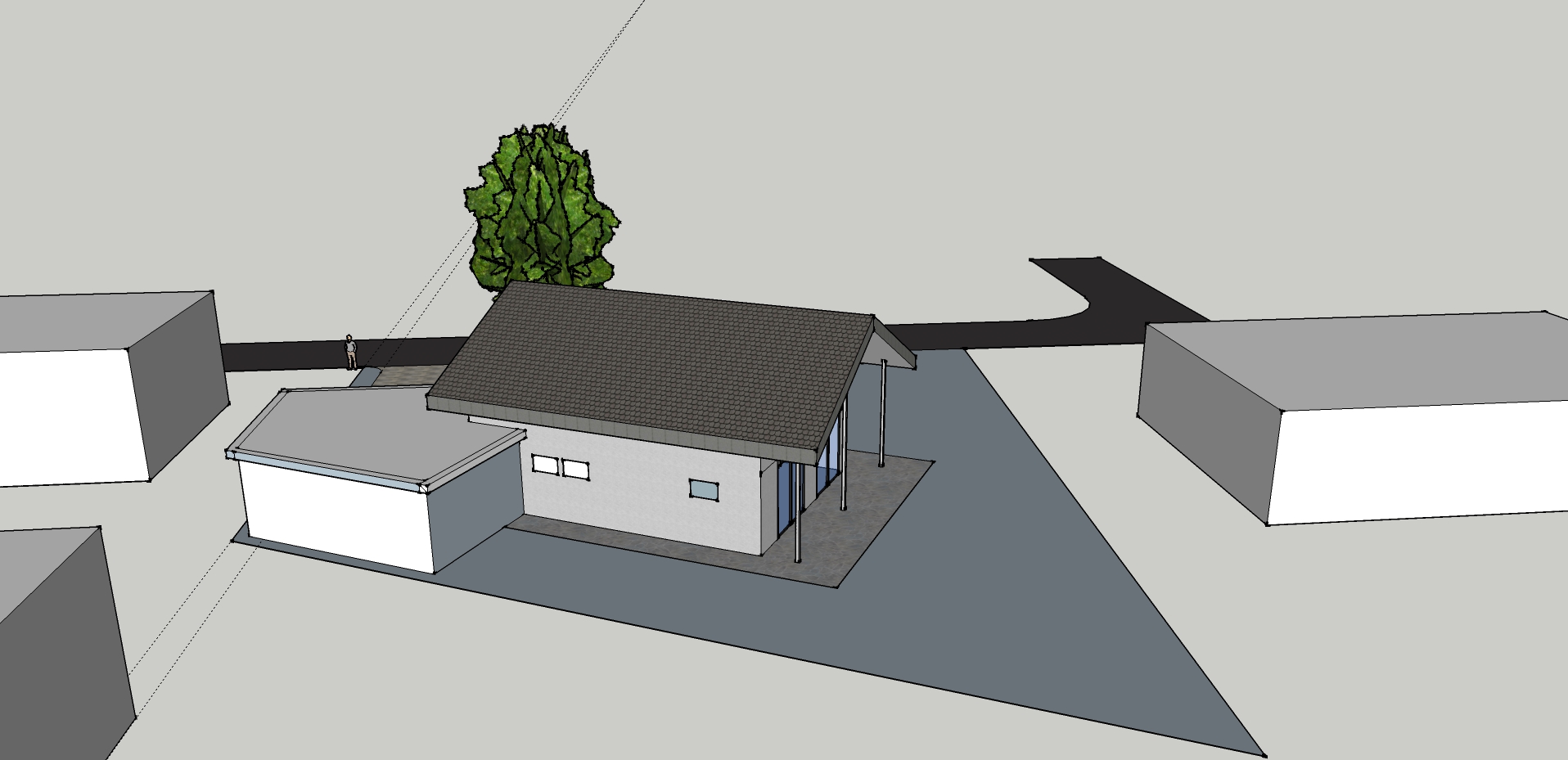

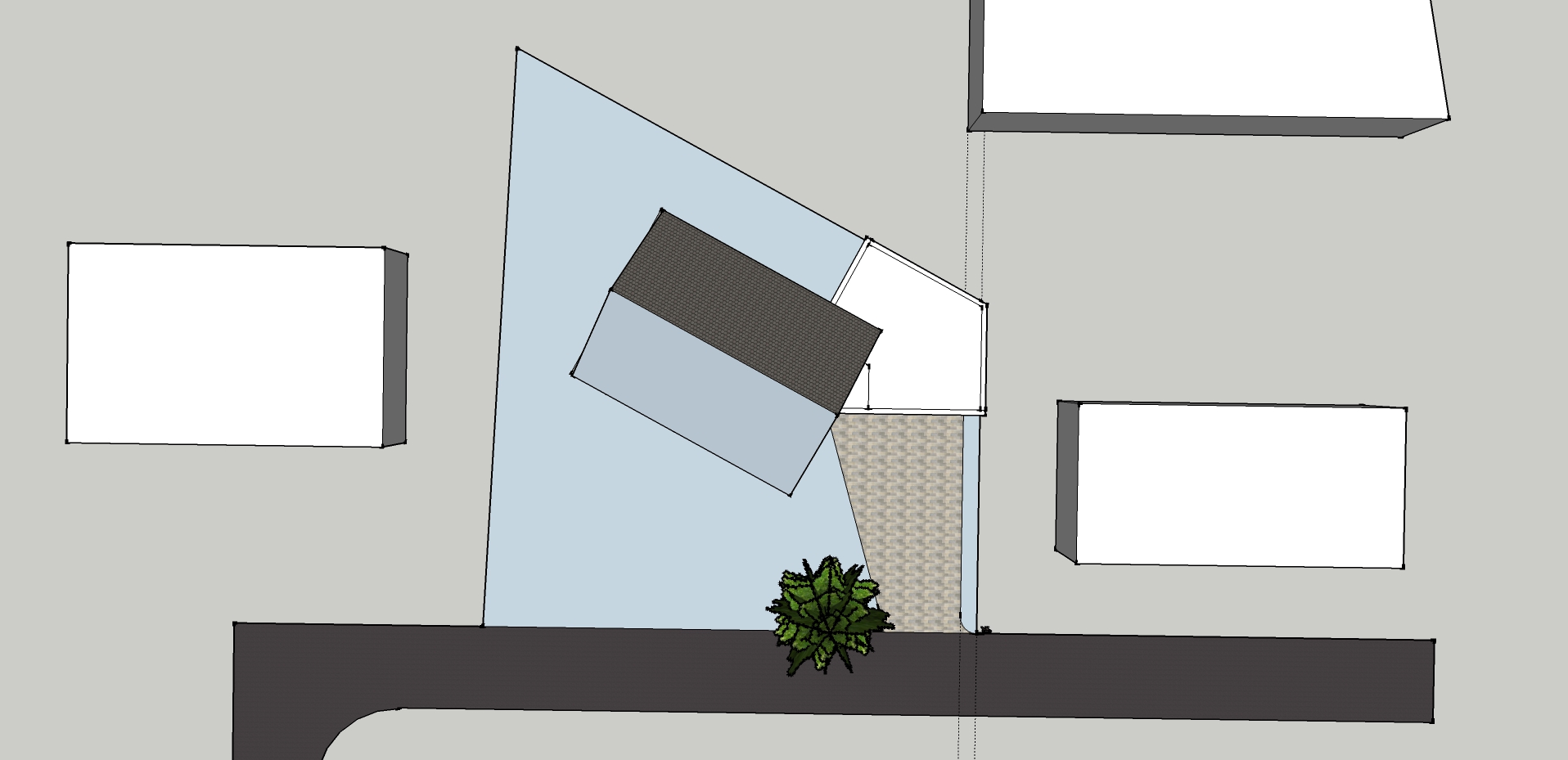

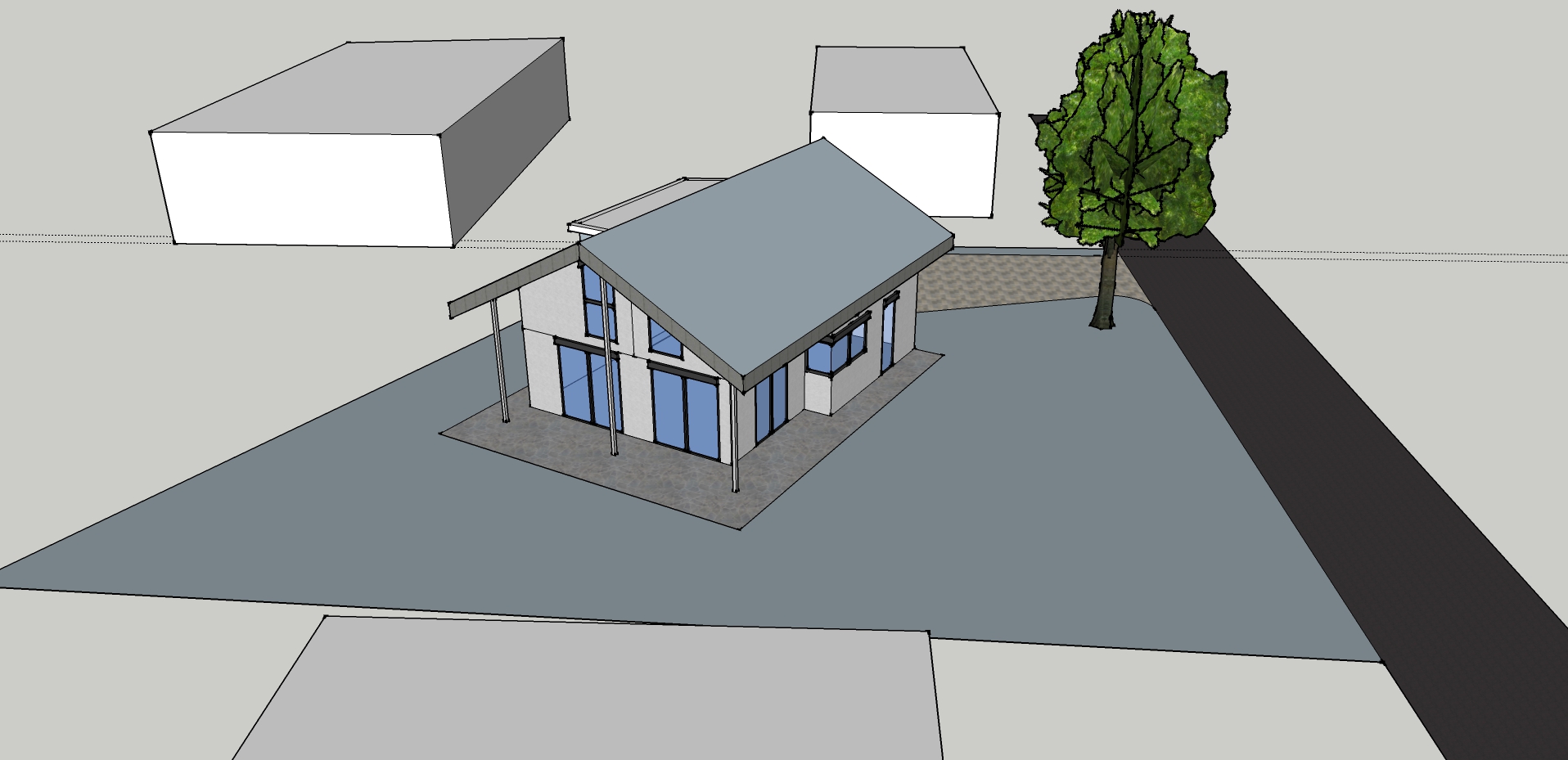

[ATTACH alt="entwurf-steht-nun-gehts-an-die-finanzierung-86789-1.jpg" type="full"]4890[/ATTACH]

Hello everyone,

we had a wooden house designed by an engineering company. The location on the building plot and the design are right, but I still have concerns about the costs. I would be interested to hear what you think about it. Maybe we are wearing rose-colored glasses and no longer notice anything :)

Total costs: 570,000 Euro

included:

- Building plot 126,000 + 9,000 incidental costs

- Kitchen 15,000

- Bathroom furniture 3,000

- Driveway 6,000

- Terrace 12,000

- House connections

- Architect’s services

- Surveying etc...

The house will be a Kfw55 (calculation will only be done in the specific planning = risk) with approx. 160sqm living space. 1.5 stories. A lot of glass is used, windows wood/aluminum and roller shutter slats. The heating system planned is a Daikin (Rotex) air-water heat pump (Daikin is well known) with an additional stove with water jacket and 500L storage tank, which heats the floors. There is a garage with electric gate (5m) and green flat roof. The garage size is 60sqm (special request from me). No basement, everything on a slab foundation (otherwise it would be even more expensive!).

Now to our financial situation:

Net income you: 1400 (Employee AD, company car 1% deducted)

Net income partner: 3300 (Employee AD, company car 1% deducted)

Equity: 150k Euro

- of which 20k in Wohnriester (Schwäbisch Hall 1% credit balance, 2.95% debit interest)

Financing need: 420,000 Euro

We have received our first offer from VR + Schwäb.H. A forward loan for 7 years was generated (until the Wohnriester is 40% paid) - this is relatively cheap at 1% - however, after these 7 years the debit interest rate of 2.95% applies (advisor’s statement, it might be handled differently). 50k comes from the L-Bank or Kfw at approx. 0.75-0.8%. For the rest, a 250k annuity loan was included at an interest rate of 1.3% for 10 years.

Unfortunately, our requirement of a maximum monthly burden of 1600 was not met. The first 5 years at the L-Bank are interest-only, so approx. 1450 Euro monthly rate. Then the repayment of 150 Euro comes in – so 1600.... after 7 years the Wohnriester forward loan runs out and there is another increase to about 1750 Euro.

For me, three questions arise:

- Is it worth integrating the Riester contracts or should they be dissolved?

- Does the financing sound okay, or are we better off with pure annuity loans?

- What do you think of the total construction sum of 570,000 Euro? Our pain threshold was moved from 500 to 550 ... now we end up at 570,000.

I look forward to your answers and wish you a great start to spring!

I am attaching some pictures as well :)

Hello everyone,

we had a wooden house designed by an engineering company. The location on the building plot and the design are right, but I still have concerns about the costs. I would be interested to hear what you think about it. Maybe we are wearing rose-colored glasses and no longer notice anything :)

Total costs: 570,000 Euro

included:

- Building plot 126,000 + 9,000 incidental costs

- Kitchen 15,000

- Bathroom furniture 3,000

- Driveway 6,000

- Terrace 12,000

- House connections

- Architect’s services

- Surveying etc...

The house will be a Kfw55 (calculation will only be done in the specific planning = risk) with approx. 160sqm living space. 1.5 stories. A lot of glass is used, windows wood/aluminum and roller shutter slats. The heating system planned is a Daikin (Rotex) air-water heat pump (Daikin is well known) with an additional stove with water jacket and 500L storage tank, which heats the floors. There is a garage with electric gate (5m) and green flat roof. The garage size is 60sqm (special request from me). No basement, everything on a slab foundation (otherwise it would be even more expensive!).

Now to our financial situation:

Net income you: 1400 (Employee AD, company car 1% deducted)

Net income partner: 3300 (Employee AD, company car 1% deducted)

Equity: 150k Euro

- of which 20k in Wohnriester (Schwäbisch Hall 1% credit balance, 2.95% debit interest)

Financing need: 420,000 Euro

We have received our first offer from VR + Schwäb.H. A forward loan for 7 years was generated (until the Wohnriester is 40% paid) - this is relatively cheap at 1% - however, after these 7 years the debit interest rate of 2.95% applies (advisor’s statement, it might be handled differently). 50k comes from the L-Bank or Kfw at approx. 0.75-0.8%. For the rest, a 250k annuity loan was included at an interest rate of 1.3% for 10 years.

Unfortunately, our requirement of a maximum monthly burden of 1600 was not met. The first 5 years at the L-Bank are interest-only, so approx. 1450 Euro monthly rate. Then the repayment of 150 Euro comes in – so 1600.... after 7 years the Wohnriester forward loan runs out and there is another increase to about 1750 Euro.

For me, three questions arise:

- Is it worth integrating the Riester contracts or should they be dissolved?

- Does the financing sound okay, or are we better off with pure annuity loans?

- What do you think of the total construction sum of 570,000 Euro? Our pain threshold was moved from 500 to 550 ... now we end up at 570,000.

I look forward to your answers and wish you a great start to spring!

I am attaching some pictures as well :)