MJK2012

2020-01-22 00:06:58

- #1

Hello dear forum community,

my wife (32), our son (8), and I (30) want to build a house with a granny flat. My parents would move into the granny flat.

We are currently looking for plots of land in the district of Neu-Ulm.

I know from some acquaintances who have recently built that they got their plots for about €260/sqm.

I will explain our situation in more detail because it is somewhat different from normal.

We currently live in a semi-detached house, which I bought in 2013 for €180,000. We will sell this year and move rent-free into my father-in-law’s apartment so that we can save equity (€1,500 per month) until we find a plot of land. We will rent out this apartment when we move into the house. However, I do not include this in the income. There was another apartment that my wife received from her grandmother, but it was sold (our equity + savings) because we only had trouble with antisocial tenants. We got the semi-detached house very cheaply at the time because the previous owner was in the middle of building a house in Magdeburg and ran out of money. We hired a real estate agent who estimates the semi-detached house at about €370,000. After deducting the prepayment penalty and paying off the remaining debt, we would have about €200,000 (equity) left.

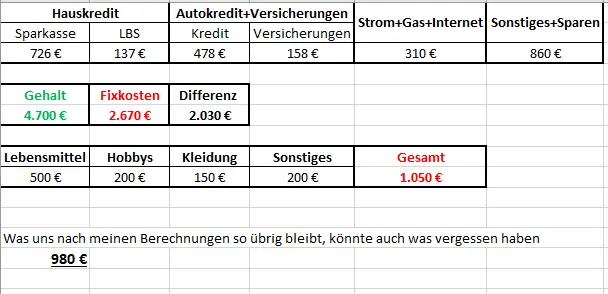

So we have about €980 left per month after all calculable costs if I haven’t made any mistakes.

Equity:

€70,000 from the apartment sale

€30,000 saved - €30,000 car loans = €0

€1xx.xxx from what remains from the semi-detached house.

Debts:

Car loan 1: €300 monthly installment; the loan will be paid off from equity

Car loan 2: €179 monthly installment; the loan will be paid off from equity

Loan:

We assume that we will need about 36 months to buy the plot + house. We calculate €200,000 for the plot and €450,000 for the single-family house + granny flat. The costs would then amount to about €750,000 including a buffer. If I deduct our equity (€70,000 + €200,000 + 36 months * €1,500), a financing amount of €425,000 would still remain.

Have I now calculated the costs for the plot + house nicely, or is this about right?

The house should have 150-170 sqm + 60 sqm granny flat. No garage is planned. Possibly a carport or something like that.

I hope my post is understandable and I look forward to your answers.

Regards

MJK2012

my wife (32), our son (8), and I (30) want to build a house with a granny flat. My parents would move into the granny flat.

We are currently looking for plots of land in the district of Neu-Ulm.

I know from some acquaintances who have recently built that they got their plots for about €260/sqm.

I will explain our situation in more detail because it is somewhat different from normal.

We currently live in a semi-detached house, which I bought in 2013 for €180,000. We will sell this year and move rent-free into my father-in-law’s apartment so that we can save equity (€1,500 per month) until we find a plot of land. We will rent out this apartment when we move into the house. However, I do not include this in the income. There was another apartment that my wife received from her grandmother, but it was sold (our equity + savings) because we only had trouble with antisocial tenants. We got the semi-detached house very cheaply at the time because the previous owner was in the middle of building a house in Magdeburg and ran out of money. We hired a real estate agent who estimates the semi-detached house at about €370,000. After deducting the prepayment penalty and paying off the remaining debt, we would have about €200,000 (equity) left.

So we have about €980 left per month after all calculable costs if I haven’t made any mistakes.

Equity:

€70,000 from the apartment sale

€30,000 saved - €30,000 car loans = €0

€1xx.xxx from what remains from the semi-detached house.

Debts:

Car loan 1: €300 monthly installment; the loan will be paid off from equity

Car loan 2: €179 monthly installment; the loan will be paid off from equity

Loan:

We assume that we will need about 36 months to buy the plot + house. We calculate €200,000 for the plot and €450,000 for the single-family house + granny flat. The costs would then amount to about €750,000 including a buffer. If I deduct our equity (€70,000 + €200,000 + 36 months * €1,500), a financing amount of €425,000 would still remain.

Have I now calculated the costs for the plot + house nicely, or is this about right?

The house should have 150-170 sqm + 60 sqm granny flat. No garage is planned. Possibly a carport or something like that.

I hope my post is understandable and I look forward to your answers.

Regards

MJK2012