moHouse

2020-07-27 11:31:54

- #1

Hello everyone,

we currently have a specific plot of land in sight. As is often the case, there are once again some special circumstances where we would like to get the opinion of others.

Basics:

Plot size: just under 610 sqm

Building envelope: approx. 9x13m

Location: building gap in a new development area from the late 90s.

The house is located in the 2nd row to a quiet street. Access via private road - shared with neighbor.

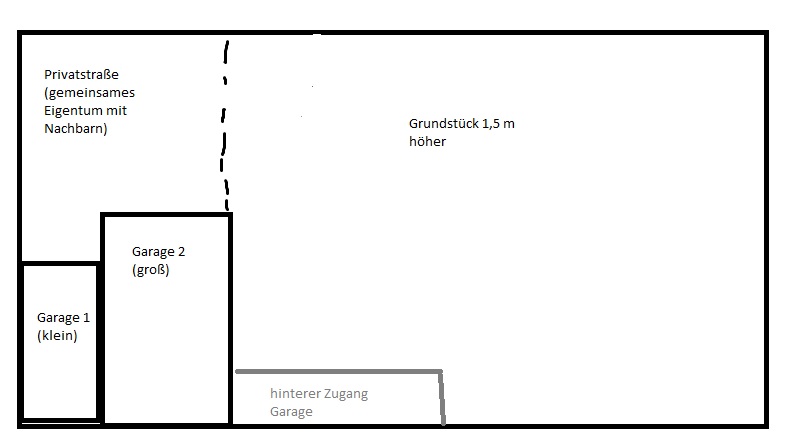

Existing structures: there are currently 2 garages on the plot (see picture)

The plot is flat. However, it is on 2 levels. The front area (approx. 45 sqm) near the garages is about 1.5m lower than the rest. The transition is a steep edge.

Special feature: for the larger of the two garages (approx. 40 sqm) a usufruct right must be granted for 15 years. Including usufruct right of access to the garage from the back via footpath. Obviously also from the front.

Background: the current owner resides on the neighboring plot. In the large garage is his caravan, on which he likes to tinker (smaller, mostly electronic tinkering. He himself is 70)

Inheritance of the usufruct right is excluded. If he dies earlier, the usufruct right ends earlier.

Price:

Standard land value

+ former proportional connection costs

+ price for smaller garage

+ proportional access via private road (based on half the standard land value)

The larger garage is not separately priced (it probably once cost 40k).

The picture is purely schematic. Neither the proportions nor the orientation, arrangement, etc. are accurate in detail.

our current opinion:

It suits us. The residential area is very nice with a few manageable disadvantages (nothing is perfect).

The price of the plot basically fits (at our budget limit). There are practically no building gaps left in this area. Even fewer willing to sell. And if so, then usually 50% or more above the standard land value.

We can basically live with the usufruct right. One garage is enough for us. At the rear access to the garage there would be a dead corner on the plot anyway.

Now the question: have we forgotten anything? Does the usufruct right involve any disadvantages that we have currently overlooked? We get along well with the current owner after several conversations and the first meeting.

The gentleman is 70, has no other relatives in the area (except his wife).

Disadvantages we can think of now:

- we might fall out with the current owner at some point. Then he may still enter our property and tinker very close to us

- the usufructuary is basically allowed to sublet the garage. So theoretically it could be that a louder tinkerer moves in there. (this might be excluded in the contract)

- the banks will not like the usufruct right. Is the value of the usufruct right deducted from the total value according to the formula here? (that would be relatively unproblematic because the garage is worth far more than the usufruct right)

We have some concerns that this could endanger the financing.

What else might we have forgotten at the moment?

Thanks in advance!

we currently have a specific plot of land in sight. As is often the case, there are once again some special circumstances where we would like to get the opinion of others.

Basics:

Plot size: just under 610 sqm

Building envelope: approx. 9x13m

Location: building gap in a new development area from the late 90s.

The house is located in the 2nd row to a quiet street. Access via private road - shared with neighbor.

Existing structures: there are currently 2 garages on the plot (see picture)

The plot is flat. However, it is on 2 levels. The front area (approx. 45 sqm) near the garages is about 1.5m lower than the rest. The transition is a steep edge.

Special feature: for the larger of the two garages (approx. 40 sqm) a usufruct right must be granted for 15 years. Including usufruct right of access to the garage from the back via footpath. Obviously also from the front.

Background: the current owner resides on the neighboring plot. In the large garage is his caravan, on which he likes to tinker (smaller, mostly electronic tinkering. He himself is 70)

Inheritance of the usufruct right is excluded. If he dies earlier, the usufruct right ends earlier.

Price:

Standard land value

+ former proportional connection costs

+ price for smaller garage

+ proportional access via private road (based on half the standard land value)

The larger garage is not separately priced (it probably once cost 40k).

The picture is purely schematic. Neither the proportions nor the orientation, arrangement, etc. are accurate in detail.

our current opinion:

It suits us. The residential area is very nice with a few manageable disadvantages (nothing is perfect).

The price of the plot basically fits (at our budget limit). There are practically no building gaps left in this area. Even fewer willing to sell. And if so, then usually 50% or more above the standard land value.

We can basically live with the usufruct right. One garage is enough for us. At the rear access to the garage there would be a dead corner on the plot anyway.

Now the question: have we forgotten anything? Does the usufruct right involve any disadvantages that we have currently overlooked? We get along well with the current owner after several conversations and the first meeting.

The gentleman is 70, has no other relatives in the area (except his wife).

Disadvantages we can think of now:

- we might fall out with the current owner at some point. Then he may still enter our property and tinker very close to us

- the usufructuary is basically allowed to sublet the garage. So theoretically it could be that a louder tinkerer moves in there. (this might be excluded in the contract)

- the banks will not like the usufruct right. Is the value of the usufruct right deducted from the total value according to the formula here? (that would be relatively unproblematic because the garage is worth far more than the usufruct right)

We have some concerns that this could endanger the financing.

What else might we have forgotten at the moment?

Thanks in advance!